If you want to get out of debt in 2026 but refuse to live on rice and beans, this is for you.

You don’t have to give up your entire life to make real progress.

You don’t have to cancel travel, stop date nights, or swear off coffee forever.

You can get out of debt and still be bougie on a budget.

Today we’re walking you through:

- How to list every debt on one page

- How to set up realistic payments

- The 3 different ways to pay off debt

- Why minimum payments are what you need to budget for

- How to determine how much extra you can pay on debt / put toward debt payoff

- How to stop relying on debt for everyday life

This is how you make 2026 the year it finally sticks.

What “Bougie on a Budget” Actually Means

Let’s clear this up.

Bougie on a budget does not mean:

- Spending recklessly

- Ignoring your debt

- Pretending budgeting doesn’t matter

It does mean:

- You don’t give up your entire life to get out of debt

- You keep what matters most to you in the budget

- You build a plan that works in this season of life

We’re trained by Dave Ramsey. We’ve taught Financial Peace University. We’ve helped a lot of people get out of debt.

And here’s what we know:

What worked when you were younger, had fewer responsibilities, or fewer kids may not work now.

Most people are willing to work hard.

They’re just not willing to live miserably while doing it.

Good news. You don’t have to.

Step 1: Get Every Debt Out of Your Head and Onto One Page

Before you talk strategy, you need clarity.

That means listing every single debt:

- Name of the debt

- Type (credit card, car, medical, etc.)

- Current balance

- Interest rate

- Minimum payment

Most people have never seen their full debt picture in one place.

Not because they’re irresponsible, but because it’s uncomfortable.

Here’s the mindset shift:

This is data, not drama.

Seeing the numbers is the first step to changing them.

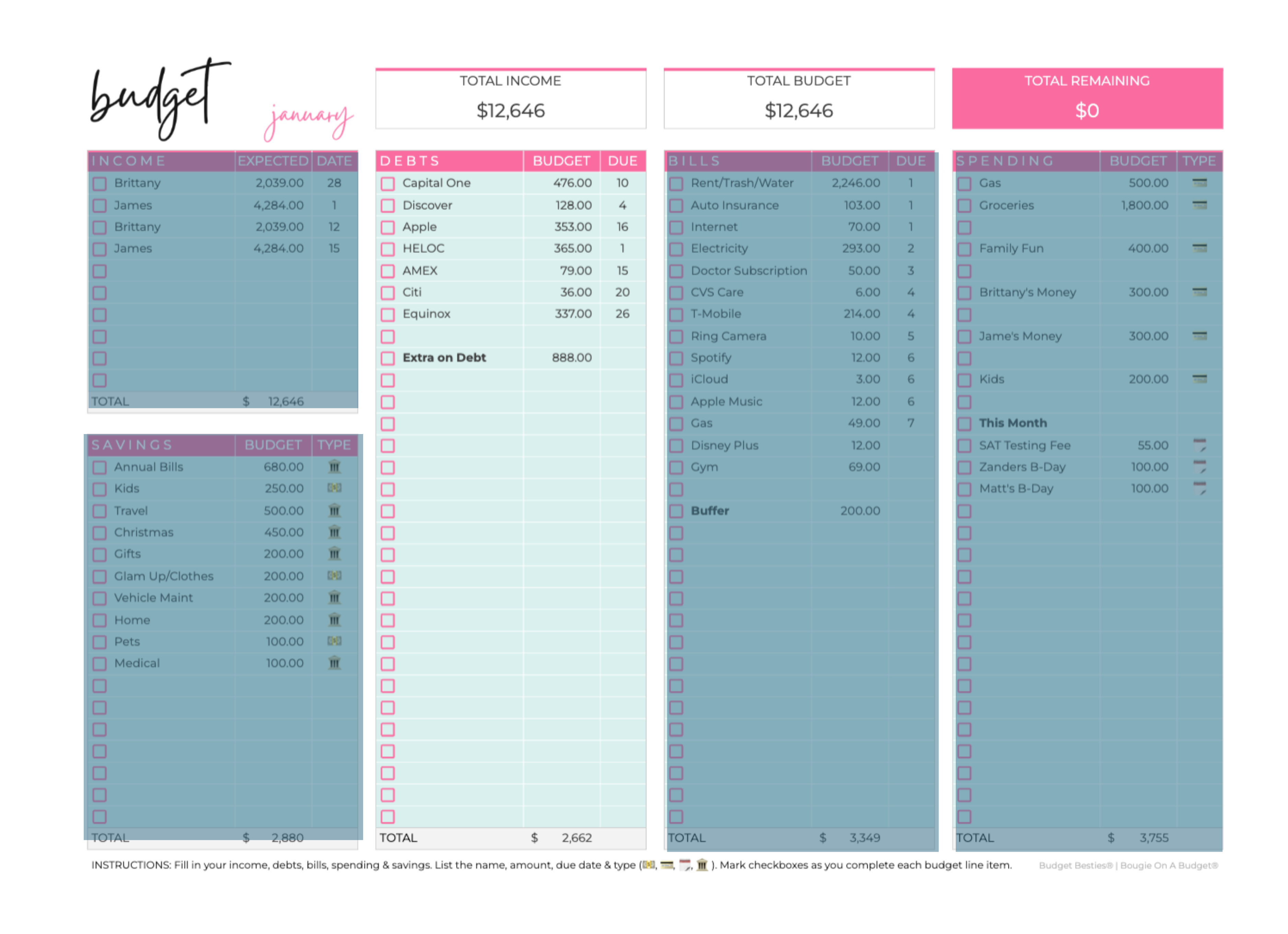

If you’re using our Simplified Budget System, the debt tracker does this for you in one clean, simple view.

Step 2: Build a Realistic Monthly Budget (Yes, You Need One)

Once you’ve listed your debts, the next step is non-negotiable.

You need a monthly budget.

Not a restrictive one.

Not a budget that feels like a punishment.

A realistic budget that matches your actual life.

Your budget should include:

- Income

- Minimum debt payments only

- Bills

- Spending (food, gas, fun, life)

- Savings (so you don’t slide back)

This is where most people have a huge realization:

“If I actually stuck to a realistic budget, I wouldn’t need to use credit cards.”

Exactly.

Credit cards often act as a fake budget when there’s no real system in place.

Why We Only Budget Minimum Payments (At First)

This part matters.

Initially in your budget, we only list minimum debt payments.

Not extra. Not double payments. Minimum only.

Why?

Because you need to see:

- What your life actually costs

- How much money you truly have left over

Once everything else is funded realistically, that leftover number is your extra on debt.

That’s how you figure out how much you can actually pay toward debt each month without blowing up your life.

Step 3: Find Your “Extra on Debt” Number

After you subtract from your income:

- Bills

- Spending

- Savings buckets

Whatever is left is your extra on debt.

This is the money you intentionally throw at debt each month.

And here’s the magic:

When one debt is gone, its minimum payment rolls into your extra, making progress faster and faster.

No guesswork.

No white-knuckling.

Just math.

The 3 Ways to Pay Off Debt (And Why Snowball Isn’t Always Best)

We teach three legitimate methods. Not one-size-fits-all.

1. Snowball Method

Pay off debts by smallest balance first.

Great for:

- Momentum

- Quick wins

- Motivation

2. Avalanche Method

Attack the highest interest rate first.

Great for:

- Saving money on interest

- High-interest cards (hello 29.99%)

3. Minimum Payment Method

Target the debt with the highest minimum payment, even if it’s not the smallest balance.

This one surprises people.

Example:

If paying off one debt gives you $300–$800 back in your monthly budget immediately, that can be a huge win.

The key takeaway:

You’re allowed to change methods.

Your strategy can change month to month based on:

- Bonuses

- Overtime

- Cash windfalls

- Life

The budget tells you what makes sense right now.

Stop Relying on Debt (This Is the Real Win)

Getting out of debt isn’t just about balances going down.

Your first big win is:

Not adding new debt.

That’s huge.

That means:

- You’re paying cash

- You’re not using credit as a crutch

- You actually know your numbers

Many clients realize they never needed to rely on credit cards.

They just didn’t have a system. This is what setting up your budget will do for you. It will allow you to plan and pay for everything with the money you have, not borrowed money from someone else.

Be Intentionally Bougie

Here’s where most advice goes wrong.

If your budget feels miserable, you will quit.

Bougie on a budget means:

- You budget for what you love

- You keep date nights, travel, haircuts, kids activities

- You make conscious trade-offs instead of blanket sacrifices

You’re not living scorched-earth.

You’re living intentionally.

And sacrificing your health, relationships, or joy to get out of debt is not the goal.

Step 4: Become Your Own Bank

This is where everything changes.

Instead of using credit cards for:

- Car repairs

- Medical expenses

- Christmas

- Home maintenance

You build savings buckets for them.

When something happens, you borrow from yourself, not a credit card.

That moment when you realize:

“I don’t need a credit card. I already have the money.”

That’s freedom.

Learn about how to set up savings buckets here.

Final Thoughts: You Can Do This Differently

In order to get out of debt, you don’t have to:

- Eat ramen forever

- Cancel your life

- Feel guilty for wanting nice things

You can:

- Get out of debt

- Live well

- Build savings

- Be bougie on a budget

If this resonated with you:

- Share it with someone who’s struggling

- Leave a review so more people can find a different way

And if you want help calling creditors, lowering interest rates, and avoiding debt consolidation:

👉 budgetbesties.com/diydebtrelief

2026 doesn’t have to look like every other year.

You can do this differently — and still enjoy your life while you do it. 💸✨

FAQs: How to Get Out of Debt in 2026 (Without Hating Your Life)

1) How do I get out of debt in 2026?

Do these 4 things in this order:

- List every debt on one page (balance, interest rate, minimum payment)

- Build a realistic monthly budget (so you know what’s actually left over)

- Pay minimums on everything

- Put all “extra” on ONE debt at a time until it’s gone, then roll that payment to the next debt

2) What’s the fastest way to pay off debt in 2026?

Fastest usually comes from one (or a combo) of these:

- Debt avalanche: target the highest interest rate first

- Minimum-payment method: target the debt with the biggest minimum payment first

- Snowball: target the smallest balance first for quick wins

The “best” method is the one that works with your budget. It can change if you get a bonus or tax refund. You don’t have to stick with only one.

3) Do I have to give up eating out, travel, or fun to get out of debt?

No. But you do need to be intentional.

- Pick 2–3 “non-negotiables” you’re keeping (date night, travel, kids sports, Starbucks, whatever)

- Build your budget around those

- Then use what’s left to hit debt hard

This is how you get out of debt without the burnout.

4) Why do you tell people to only budget minimum payments (at first)?

Because if you “sprinkle extra” on everything, you don’t actually make progress.

Minimum payments go in the budget so you can see:

- what you’re required to pay

- how much extra you truly have each month

- what you can attack on purpose

Then you put your extra money on ONE debt at a time.

5) I keep using credit cards for “surprises.” How do I stop?

You need savings buckets (savings with a job).

Start with these first:

- Annual bills (insurance, HOA, car registration, property taxes)

- Medical

- Car repairs

- Christmas / gifts

Most “surprises” aren’t surprises. If you can start to plan for these “unexpected” expenses, you’ll stop needing to rely on debt.

6) What if I can’t afford extra payments right now?

Then your first goal for 2026 is:

- Stop adding new debt

- Get your budget realistic

- Find your “extra” by fixing the leaks (subscriptions, eating out, random Amazon, etc.)

- Even $50–$100 extra on one debt builds momentum

Progress counts even when it feels “small.”

7) Should I do debt consolidation?

Sometimes it helps, but a lot of people do it and still end up back in debt because the budget piece never changed.

Before you consolidate, try this first:

- Budget realistically

- Call and negotiate interest rates YOURSELF

- Pick a payoff method

- Build savings buckets so you don’t slide backward

8) How do I know which debt to pay off first?

Ask this:

- Which one has the highest interest rate? (avalanche)

- Which one gives me the biggest minimum payment back? (minimum-payment method)

- Which one can I knock out the fastest for a win? (snowball)

If two balances are close, usually go after the one with the nastier interest rate.

9) What’s a realistic debt payoff goal for 2026?

Realistic usually means:

- A plan you can do every month

- That still includes life (food, fun, kids, holidays)

- With a consistent “extra on debt” amount you can repeat

Most people don’t fail because they can’t do math.

They fail because the plan is miserable.